How to claim my Student Loan Interests?

Student loan interests are non-refundable tax credits, which means if your taxes are already zero without it, you won't get

any more refund.

The good thing is you can claim the interests in any of the following 6 years (including the current year) after you get the statement. If you expect higher income in the future, you can withdraw the claim this year and make the claim in the future years.

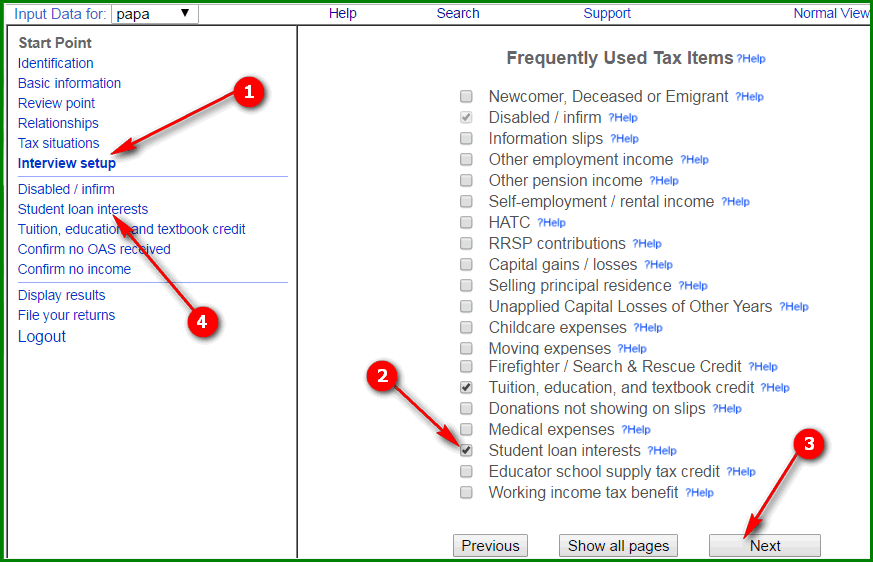

If you are in Simple view:

-

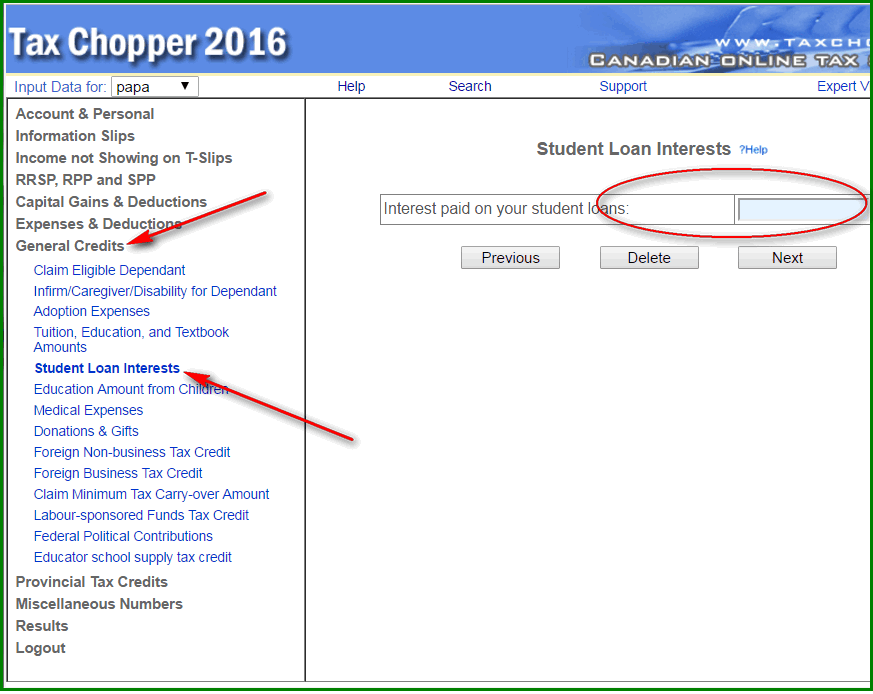

If you are in expert view: