How do I transfer/carry forward tuition amount?

The student has to make the tuition claim no matter who paid the tuition costs.

The tuition credit and transfer are non-refundable tax credit calculated based on calculation from Schedule 11. The calculation will claim an maximum amount which reduces your tax payable to zero on line 323/5856. You cannot claim an amount that is less than the calculated maximum. This is just how the tax law is written. This could mean that any credit after tuition credit will get wasted.

The maximum transferable amount is also calculated on schedule 11. The formula is $5,000 minus (your claim of current year new credit). For Ontario provincial transferable, you replace $5,000 with $6,922.

You can claim an amount that is less than the calculated transfer if your parent or spouse's income is not high enough to use the credit.

The transfer amount has to be shown on both the student and the parent (or spouse)'s returns.

Note: Unused tuition credit from previous years is not transferable.

For the student:

- Go to "Tuition, Education, and Textbook Amounts" page to claim and transfer: How?

- If the parent (or spouse) is having a return in the same account, select his/her name and tick the box "Let TaxChopper transfer the maximum". That is all you need to do to make the claim and transfer. And this is the recommend way; or

- If you don't check the box "Let TaxChopper transfer the maximum", or if the parent/spouse is not having a return in the same amount, you can specify transfer amount in two other subsequence pages. These pages will show up directly on the left side menu (simple view) or "Miscellaneous Numbers" section (expert view). If you see no such page, it means you either selected "No transfer", or the transferable amount is zero. (Click here to see picture)

For the parent / spouse who will claim the transfer:

- If the student is having a return in the same account, you don't need to do anything. The claim and transfer are all made under the student's name.

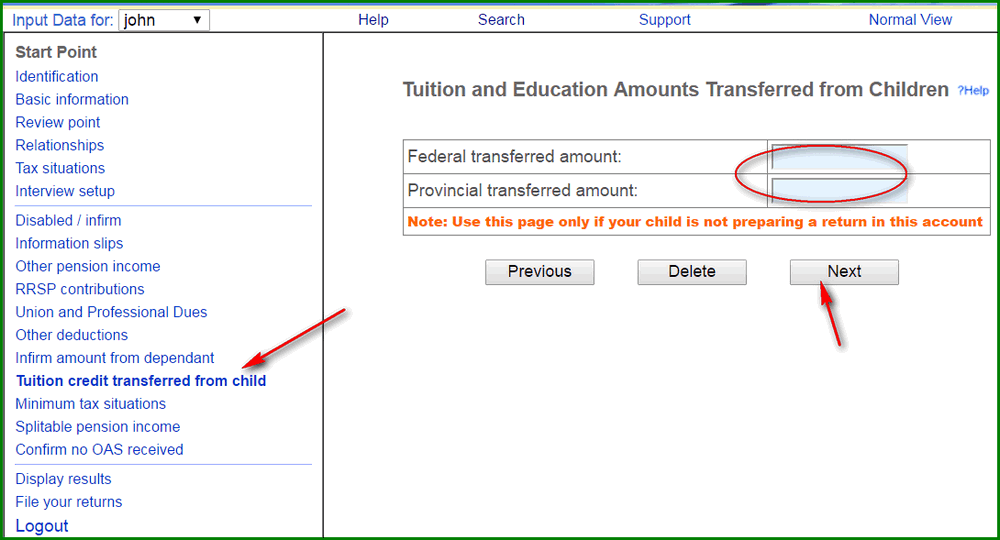

- Otherwise you will need to enter the designated transfer amount from the student's return under your name.

Refer to pictures at the bottom to see how to get to the page. Or, you can open our search page, use "324" to search, you will get the page(click "Jump to this page" from the result list).

Carry forward:

Carry forward amount are calculated automatically by the software. All unclaimed, un-transferred amount will be carried to next year. You will also observe the the amount on your notice of assessment as unused amount available for 2017.

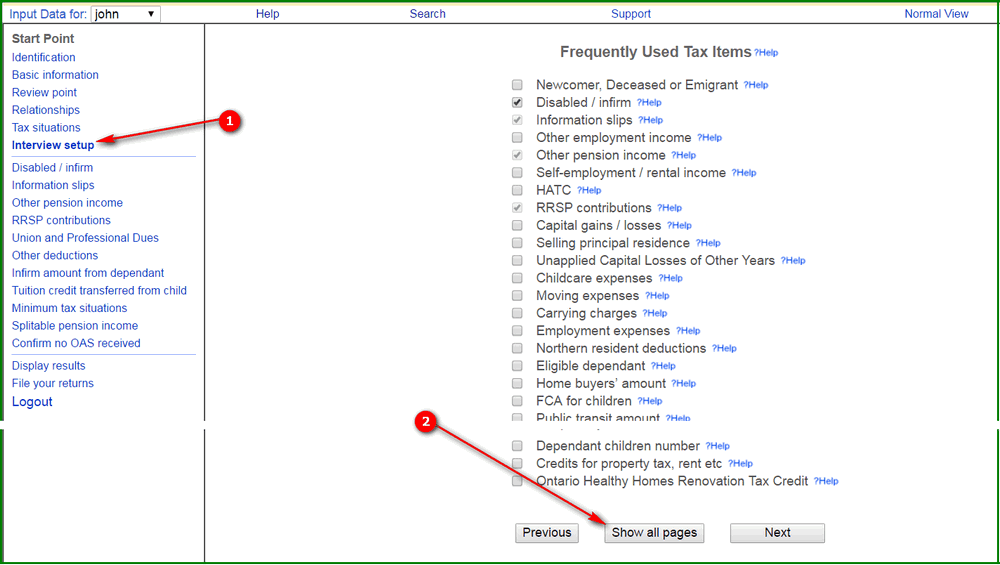

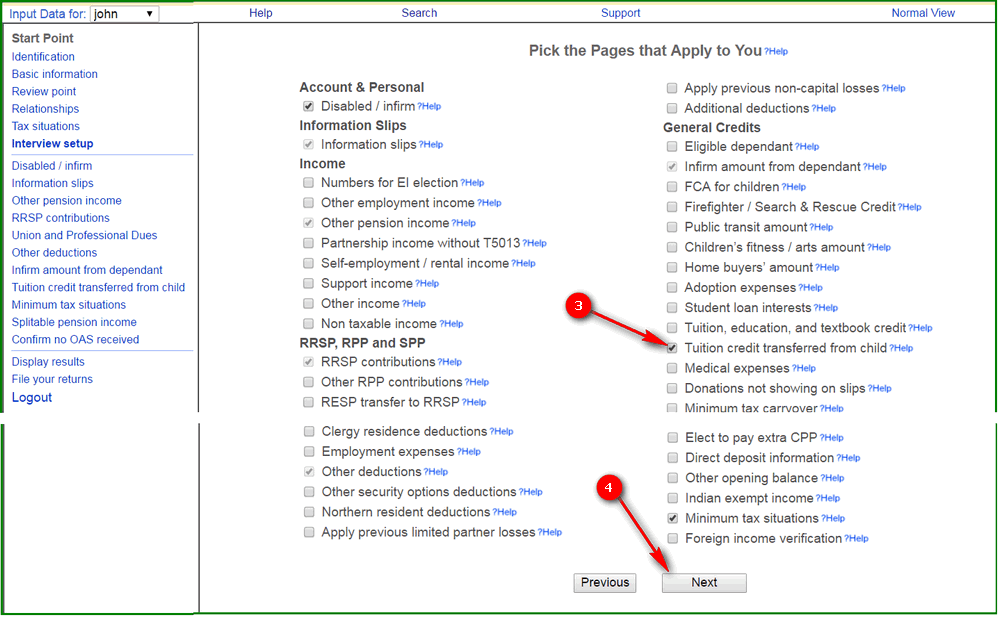

Page "Tuition and Education Amounts Transferred from Children"(in Simple View)

-

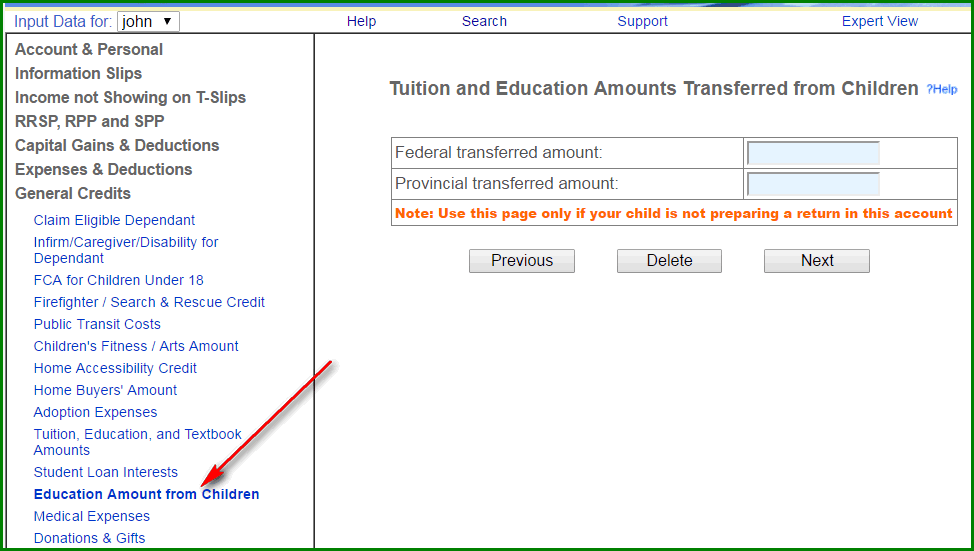

Page "Tuition and Education Amounts Transferred from Children"(in Expert View):