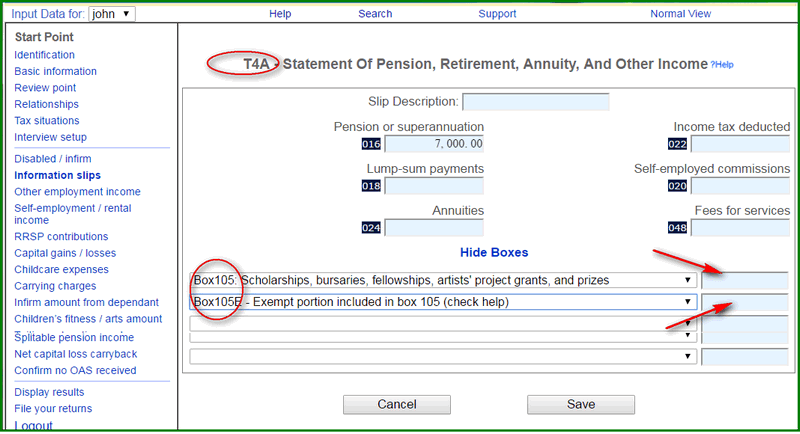

How do I enter T4A Box105?

Part or all of T4A Box 105 might be non-taxable. See CRA guide here. Usually, for most full time student, full amount is non-taxable, otherwise you have at least $500 exemption.

To prevent users from forgetting to claim the non-taxable part, the software provides with an extra box called "105 Exemption". After you entered the amount in Box 105, you have to specify the non-taxable part in this Box 105E. If full amount in Box 105 is non-taxable, enter the same amount into Box 105E. If zero is non-taxalbe, you can enter 0.01 to bypass.

Box 104, 106 and 107 needs to be entered in a similar fashion.