How to claim Working Income Tax Benefit(WITB) ?

Most people are eligible to claim WITB, which means you can use the tax form to calculate how much benefit you can get. The common ineligibility for WITB is 1) being in prison; 2) In full-time school for 3 months and without a child. See CRA guide here.

However, WITB is designed for families with very low income, mainly to offset the welfare claw-backs caused by working income. So the result for most people will be zero unless you have very low income.

We recommend you always apply for the WITB if eligible and let the software calculate how much you can get.

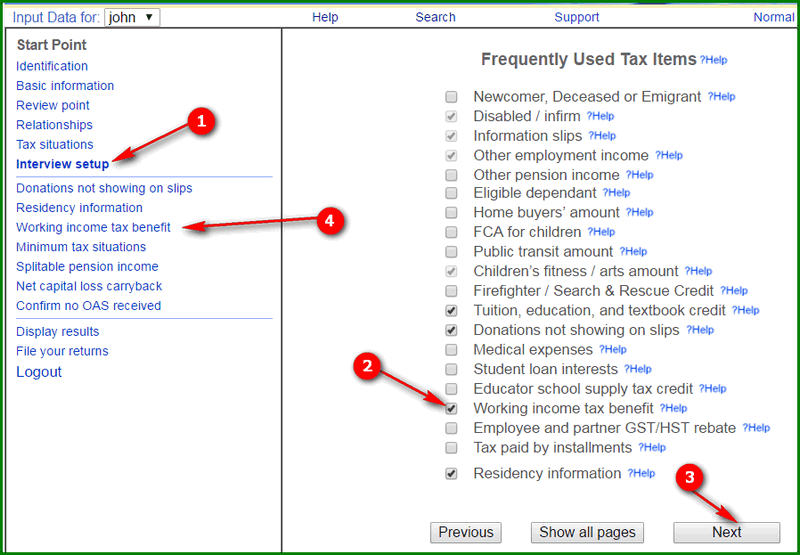

If you are in Simple view:

-

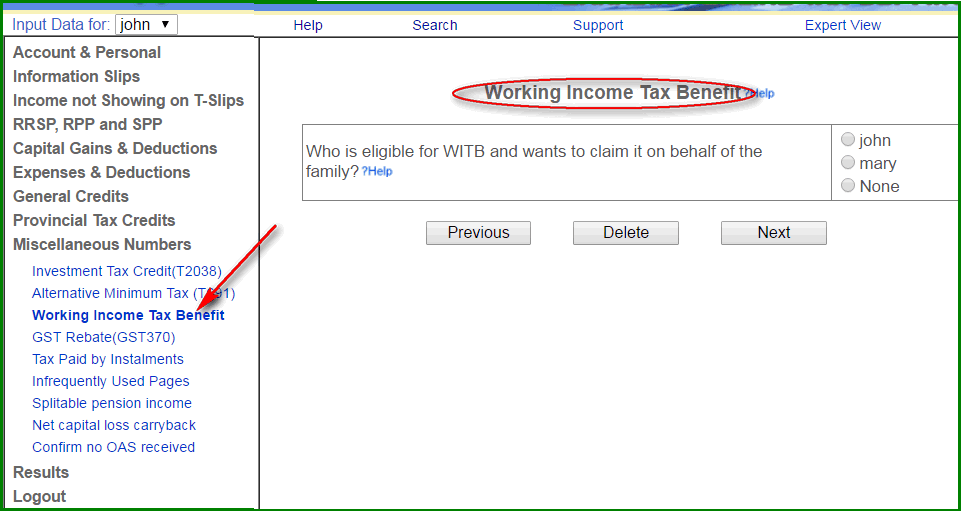

If you are in expert view: