How to claim Childcare Expenses?

Childcare expenses can only be claimed by the spouse with lower income, up to 2/3 of his/her working income.

The exceptions are that when the lower income spouse could not take care of the children due to prescribe reasons,

like going to school, in prison etc.

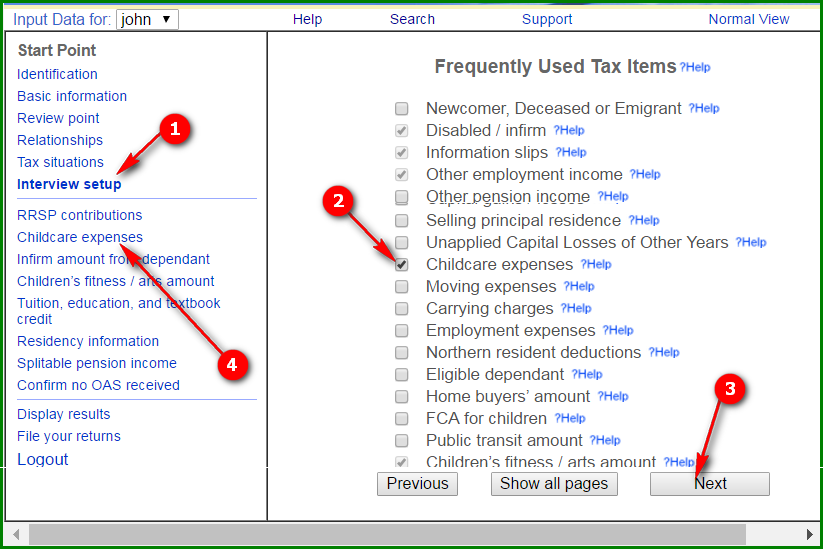

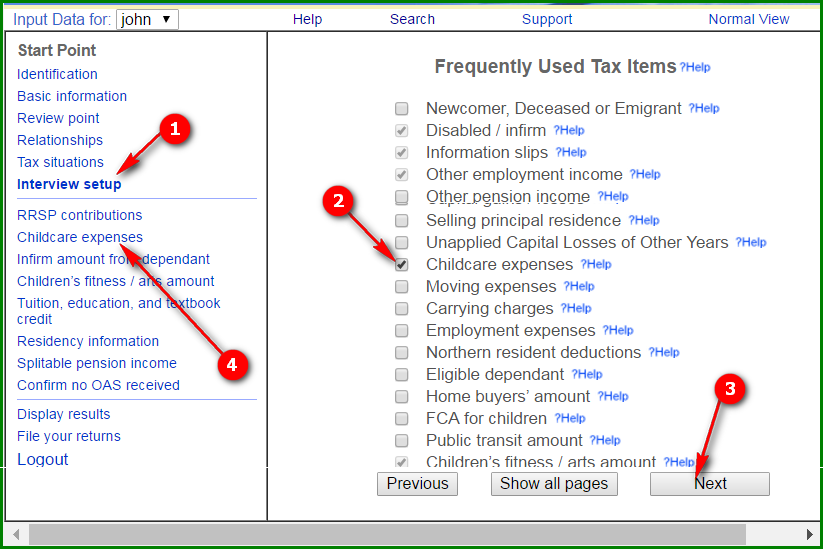

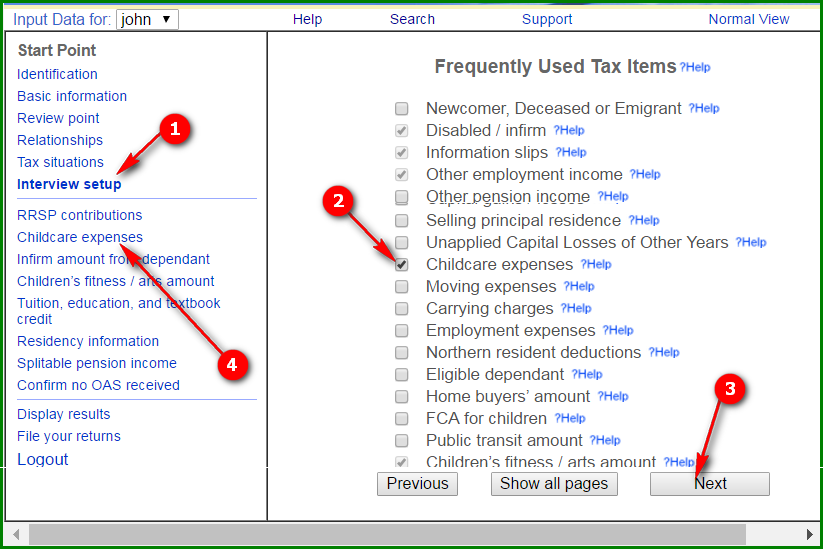

If you are in Simple View:

Click on "Interview setup" ==> check "Childcare Expenses" on the right ==> click Next at the bottom ==> click on "Childcare Expenses" on the left.

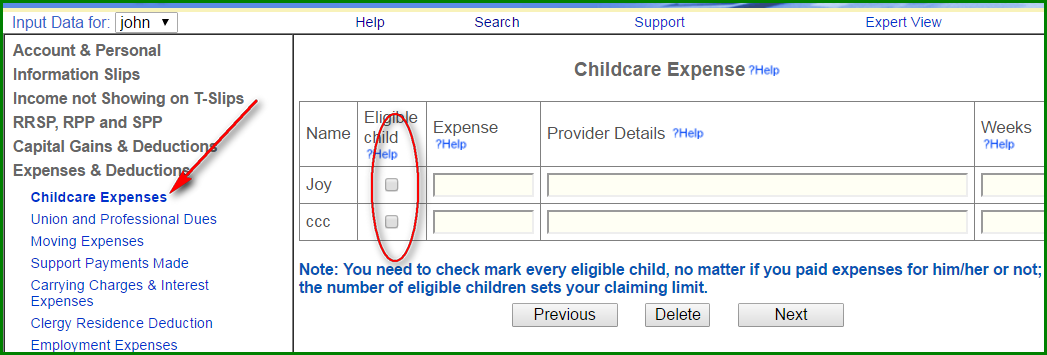

If you are in expert view:

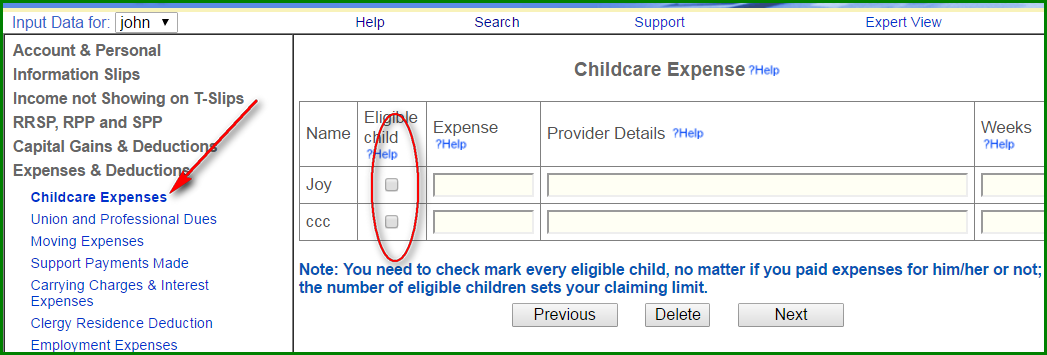

Click on "Childcare Expenses" under "Expenses & Deductions" on the left.

If you lived with a spouse, the childcare expenses page will be visible for both spouses. The software will choose the one with lower

income to make the claim unless you specify otherwise.

The conditions that the spouse with higher income can claim the childcare expenses are:

- The other supporting person attended school and was enrolled in a part-time educational program

- The other supporting person attended school and was enrolled in a full- time educational program.

- The other supporting person was incapable of caring for children because of a mental or physical

infirmity. That person must have been confined for a period of at least two weeks to a bed or

wheelchair, or as a patient in a hospital, an asylum, or other similar institution. Attach a

statement from the attending physician certifying this information.

- The other supporting person was incapable of caring for children because of a mental or physical

infirmity. This situation is likely to continue for an indefinite period. Attach a statement from

the attending physician certifying this information.

- The other supporting person was confined to a prison

or similar institution for a period of at least two weeks.

- You and your spouse or common-law partner were, due

to a breakdown in your relationship, living separate and apart at the end of

the tax year and for a period of at least 90 days beginning in the tax year, but you

reconciled before March 1, the next year.

Go Back