If you have net capital losses this year but had gains in the three previous years, you can apply the losses to the gains to reduce the taxable income in the previous years.

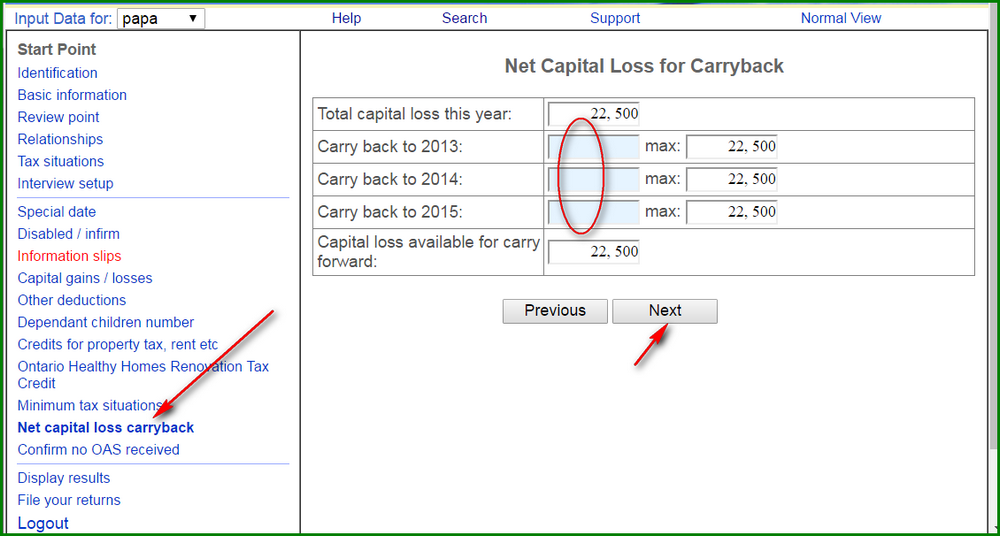

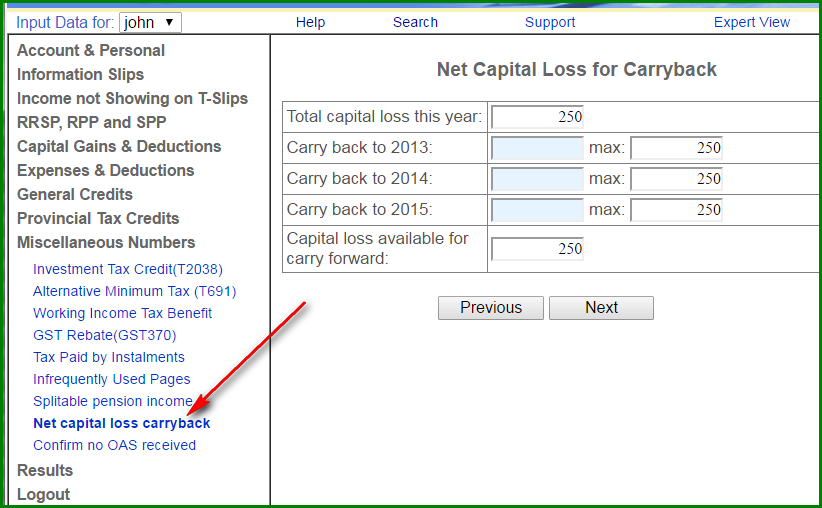

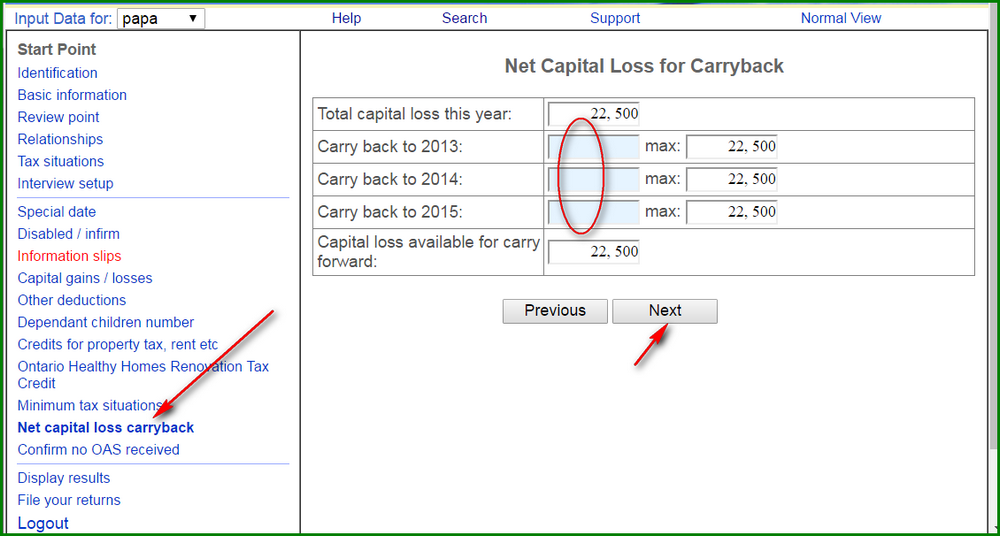

To get to the page, locate the link "Net capital loss carryback" on the left and click on it.

You can specify the loss you want to apply. The number will not affect your refund for the current tax year, it will be sent to CRA with your return. Once CRA receives it, CRA will add the numbers to line 253 of the tax year you specified, then recalculate that return and credit you the difference.