How to file a PAPER return?

In the circumstances where a return is not accepted by NETFILE/EFILE, for instance, a final return for deceased, a paper return has to be filed.

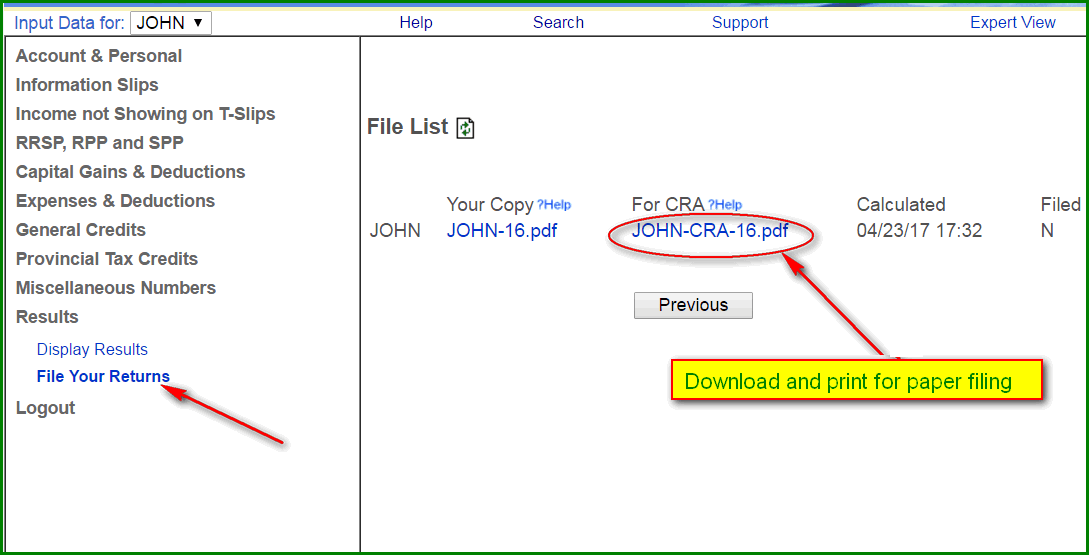

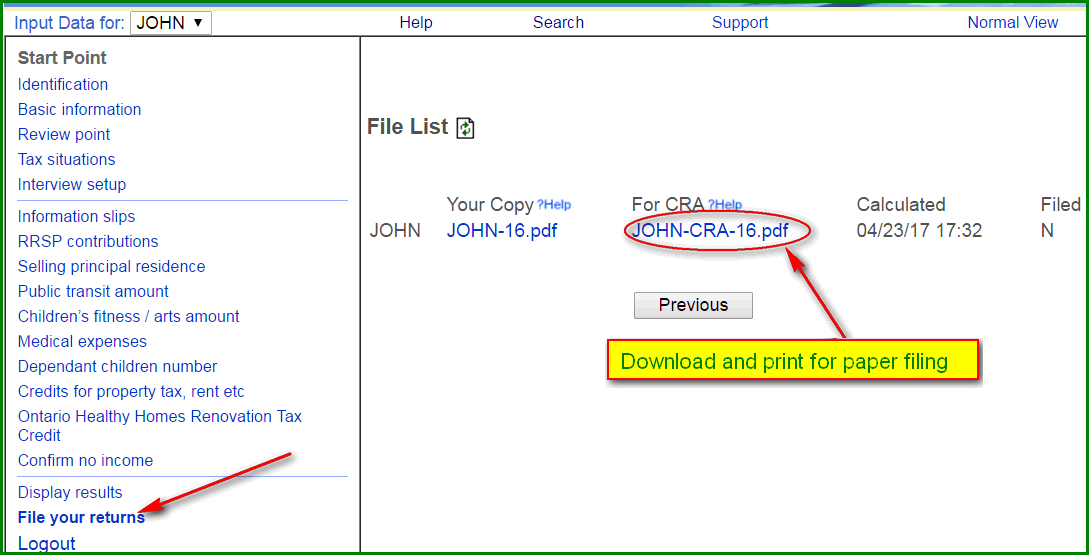

Before you go to "File your Returns" page(second picture) to download and print the return, you have to do the following:

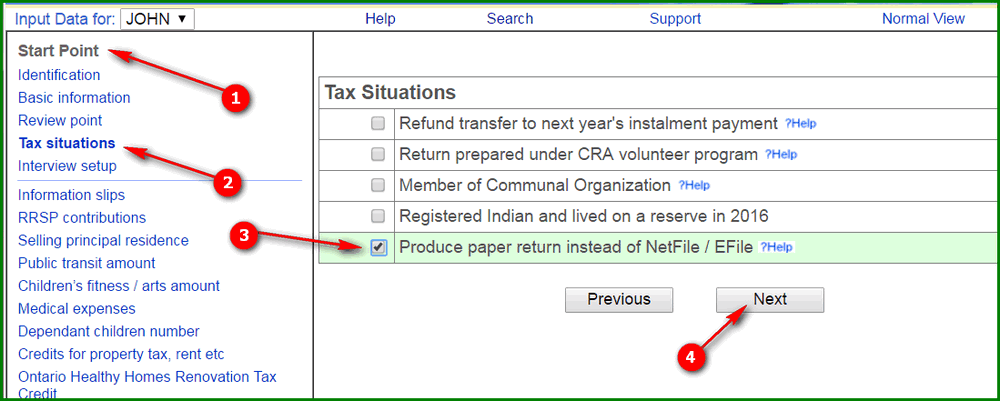

If you are in simple view

- Switch to his/her name;

- Click "Tax Situations" under "Start Point";

- Tick the box "Produce paper return instead of NetFile / EFile" and click "Next";

- Then you will be able to download the CRA-required paper return (called T1-Condensed) to print.

You also need to sign the return and attach the supporting documents like T-slips. You can find the mailing address that serves your area by clicking on this: CRA ADDRESS

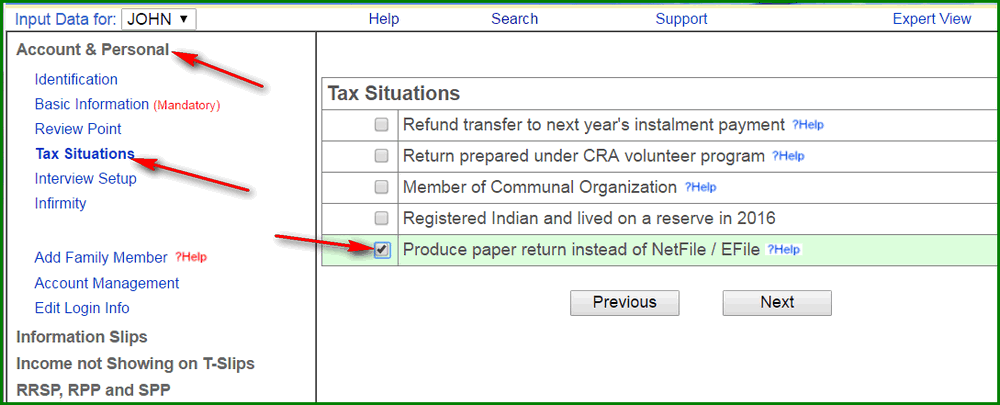

If you are in expert view

- Switch to his/her name;

- Click "Tax Situations" under "Account & Personal";

- Tick the box "Produce paper return instead of NetFile / EFile" and click "Next";

- Then you will be able to download the CRA-required paper return (called T1-Condensed) to print.

You also need to sign the return and attach the supporting documents like T-slips. You can find the mailing address that serves your area by clicking on this: CRA ADDRESS