How to report capital gains?

You report capital gain at page "Capital Gains (or Losses)".

NOTE:You don't need to enter all transaction details, no matter you paper file or e-file your return,

CRA only accepts the total gains and total proceeds. So you can summarize your transactions and only enter the total

proceeds and total costs. The corp name, number of shares, acquisition date etc can all be left blank.

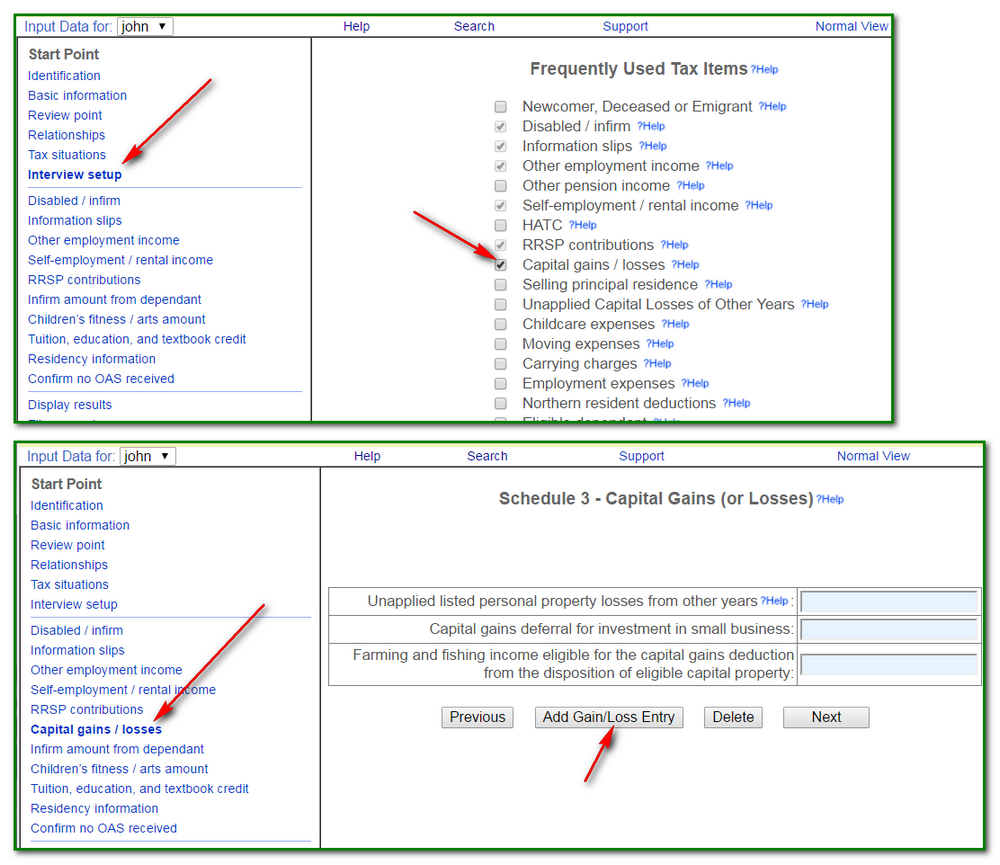

If you are in simple view:

- If "Capital gains / losses" is not listed on the left side, click "Interview Setup" on the left side, tick the box beside "Capital gains / losses", then click NEXT.

- on the left side, click "Capital gains / losses",

- on the right side, click "Add Gain/Loss Entry",

- At the next page, select a category and click Next.

- Fill in the total proceeds and total costs, the gains / losses will be calculated.

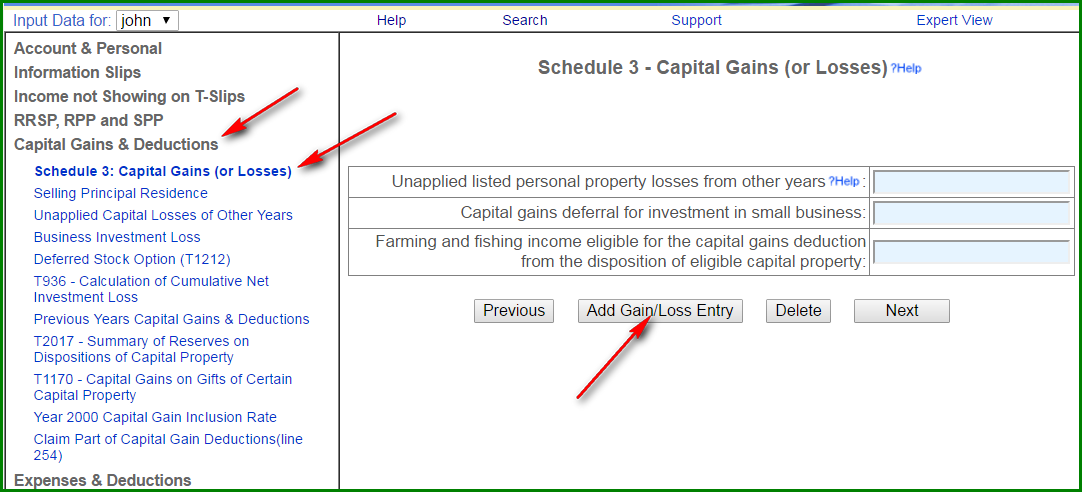

If you are in expert view

- on the left side, click "Schedule 3: Capital gains / losses",

- on the right side, click "Add gain/loss entry",

- At the next page, select a category and click Next.

- Fill in the total proceeds and total costs, the gains / losses will be calculated.